New IEA India Bioenergy Market Report Sets Out Strong Growth Outlook for Biogas and CBG in India

The IEA released its India Bioenergy Market Report: Outlook for liquid and gaseous biofuels to 2030, on 29 January 2026, providing the most comprehensive assessment to date of India’s bioenergy outlook and the role of biogas and compressed biogas (CBG) in the country’s energy transition. Demonstrating the increasing salience of biogas and CBG in the renewable energy success story, this is the first IEA country-specific full market report focused on bioenergy. The report examines current supply and demand, policy frameworks, feedstock availability and infrastructure, alongside quantified forecasts for deployment through to 2030. WBA Chief Executive Charlotte Morton was present for the launch of this report during India Energy Week 2026 in Goa.

For the biogas sector, the IEA highlights India as one of the fastest-growing markets globally, driven by supportive national policies, large volumes of agricultural residues and organic waste, and the rapid expansion of CBG production capacity. With blending obligations legislated and coming into effect from FY 2025/26 and over 460 projects operational or under construction, the report sets out both the scale of near-term growth and the longer-term potential for biogas and biomethane to contribute to energy security, waste management and emissions reduction in India.

Key takeaways:

- CBG deployment is accelerating rapidly, with around 170 plants operational by 2025 and nearly 300 additional plants under construction, bringing total planned capacity close to 3700 tonnes per day (≈1.8 bcme per year).

Forecasts

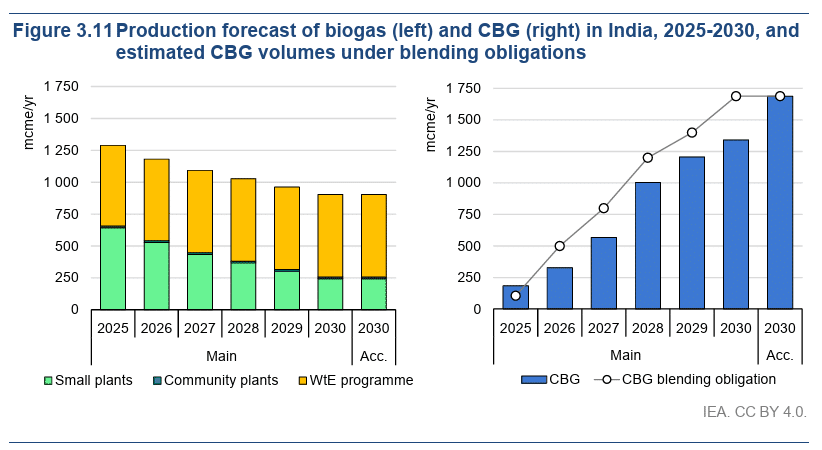

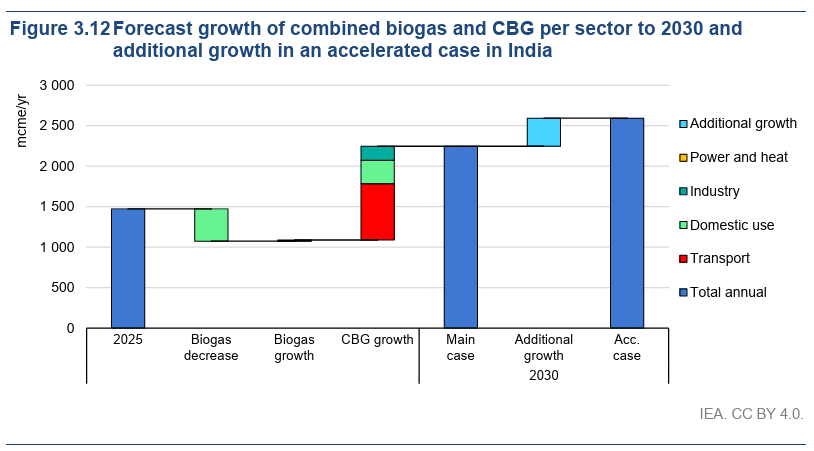

- Under current policies, combined biogas and CBG supply is forecast to grow by 53% between 2025 and 2030, with CBG production alone expected to increase more than seven-fold in the IEA’s main case timeline (reflecting current status of project pipeline and utilisation rate), and even further in its accelerated case timeline (assumes blending targets are achieved either with additional investment or production increase in existing plants).

- The forecast shows gradual decline in biogas production as seen over the past decade, particularly among small rural household facilities. The responsible ministry, Ministry of New and Renewable Energy’s National Bioenergy Programme Phase I, ends in March 2026, with no word yet on a Phase II.

- CBG is expected to be among the fastest-growing bioenergy pathways in India heading to 2030, supported by new blending obligations, expanding gas infrastructure and a rapidly growing project pipeline.

Potential

Potential

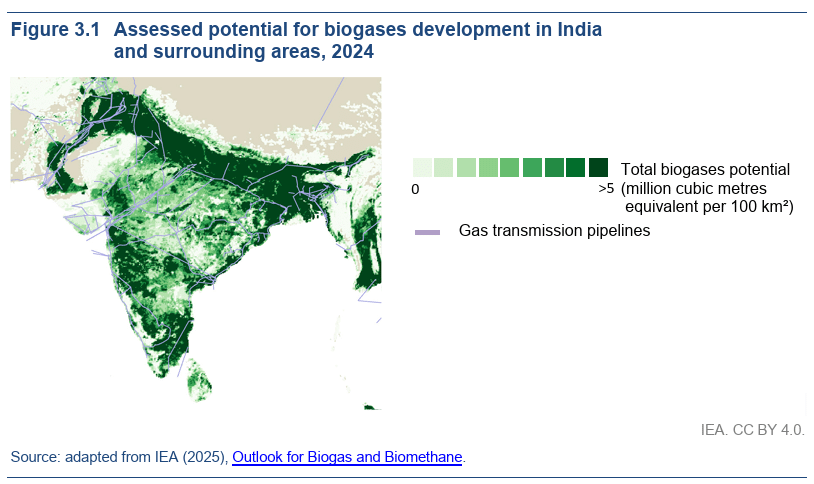

- India has an estimated sustainable CBG production potential of up to 90 bcm equivalent (bcme) per year, equivalent to around 120% of the country’s natural gas demand in 2024, highlighting the scale of domestic renewable gas resources available.

- Growth in biogas and CBG demand is expected to be led by the transport sector, driven by India’s CBG blending obligation, which rises from 1% in FY 2025/26 to 5% by FY 2028/29. This is alongside rising use in domestic and industrial applications as gas city distribution networks expand.

Feedstocks

- Feedstock availability is sufficient at a national level, with crop residues, animal manure and biowaste together accounting for around 70% of India’s identified CBG potential. Within this, crop residues represent the largest share (over 45%), followed by animal manure (around 30%) and biowaste (approximately 24%). Effective aggregation, logistics and co-product markets will be critical to sustaining scale-up.

Digestate

- The report highlights that digestate, referred to as Fermented Organic Matter (FOM), contains key nutrients but has variable composition, making it better suited as a supplement to chemical fertilisers currently rather than a full replacement. With improved soil health, it is possible to gradually reduce chemical fertiliser use in the future. Farmer awareness of FOM remains low. As such, CBG producers are promoting FOM through trials and outreach, with some developing enriched products like PROM to enhance value.

- The current Market Development Assistance provided to FOM producers is well received with requests for it to be extended beyond the current April 2026 end date.

Barriers

- Plant utilisation rates (how efficiently the biogas produced at a facility) are identified as a key constraint on delivery, with average utilisation currently around 35%. The IEA notes that improving utilisation to around 44% could enable 2030 blending targets to be met without the need for additional plants.

- Infrastructure and supply chain contraints will become evident as the industry grows, making important actions such as feedstock aggregation a growing challenge.

The IEA’s findings underline the scale of opportunity for biogas and CBG in India, alongside the importance of translating policy ambition, feedstock potential and project pipelines into sustained, high-utilisation deployment. As India moves to implement blending obligations, expand gas infrastructure and scale project delivery, practical support on policy design, market frameworks and project implementation will be critical.

The WBA aims to facilitate this in India through its #MakingBiogasHappen programme, accelerating biogas industry growth by addressing fragmented policies and regulations, and creating an enabling environment for investment. #MBH is focused on the development of a high performing, safe, sustainable, and financially viable biogas sector by using the Global Biogas Regulatory Framework (GBRF) and Anaerobic Digestion Certification Scheme (ADCS) International to develop biogas action plans to accelerate biogas deployment. Beginning at the state-level, WBA is working with state governments and industry stakeholders to develop state-specific biogas action plans, with an MoU already in place in Madhya Pradesh and scope for further roll out across India. In December 2025, WBA hosted the third annual WBA INDIA Congress in Delhi, resulting in a collective call for a National Biogas Mission, with the #MBH initiative positioned to provide the building blocks to achieve this.